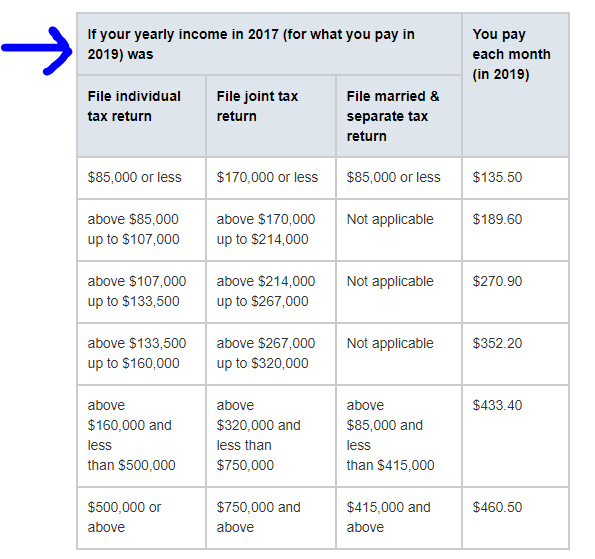

Fica Medicare Percentage 2025. There is no wage base limit for medicare tax. The medicare tax rate for 2025 remains at 1.45% of all covered earnings for employers and employees.

Your social security and medicare taxes add up to 7.65% of the money you make. The social security wage cap will be increased from the 2025 limit of $160,200 to the.

Understanding FICA, Social Security, and Medicare Taxes, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). There is no wage base limit for medicare tax.

Social Security Withholding 2025 Binny Cheslie, Fica tax includes two taxes: Fica tax is a mandatory payroll tax funding social security and medicare programs.

What Are Fica And Medicare Deductions, There is no wage base limit for medicare tax. The second half of fica is the medicare tax.

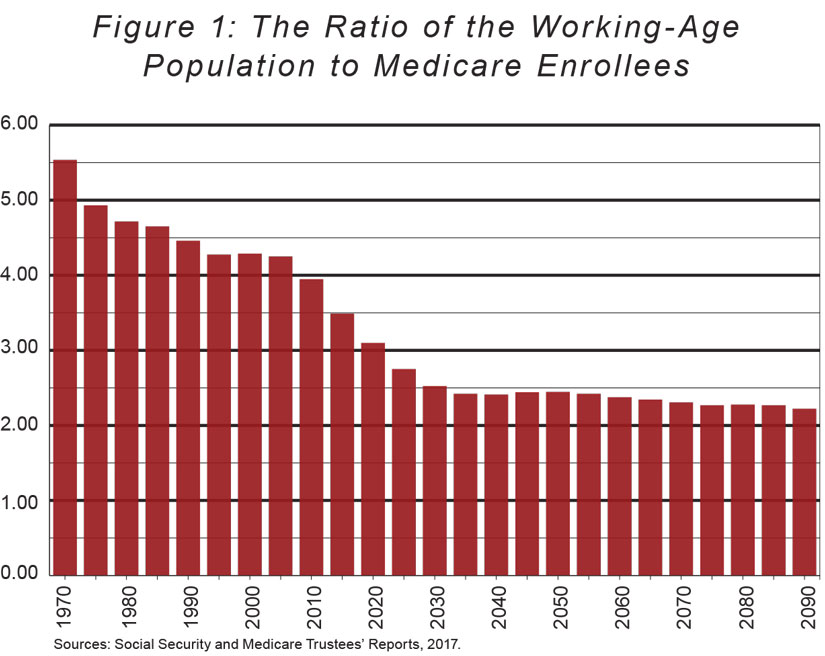

Medicare Tax Calculator 2025 Myrah Tiphany, Fica tax includes two taxes: Fica taxes include a 12.4% social security tax, although income isn't taxed beyond a certain threshold.

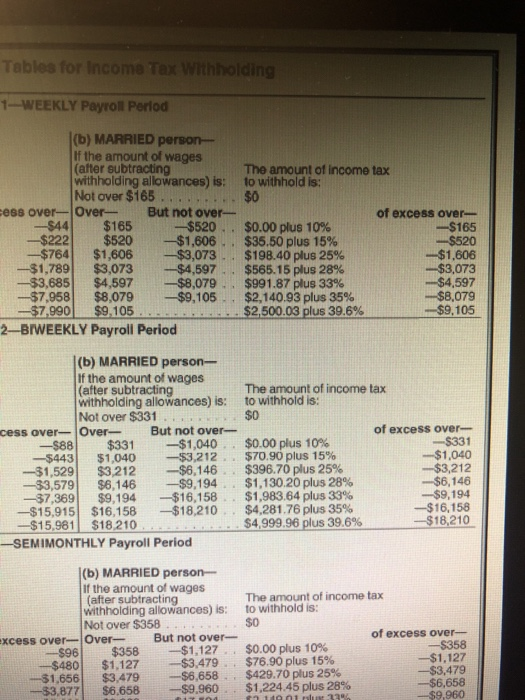

How To Check Fica Medicare Refund, Fica tax is a mandatory payroll tax funding social security and medicare programs. Federal payroll tax rates for 2025 are:

How To Calculate The Fica Medicare Expense, The rate is for both employees and employers, according to the internal revenue code. Calculate the fica medicare tax:

8.2 FICA Social Security and Medicare Withholding YouTube, 1.45% for the employee plus. Medicare tax rate for 2025:

Maximum Taxable Amount For Social Security Tax (FICA), Fica stands for the federal insurance contributions act, and it’s a federal tax that employers and employees pay. The federal insurance contributions act, commonly known as fica, is a u.s.

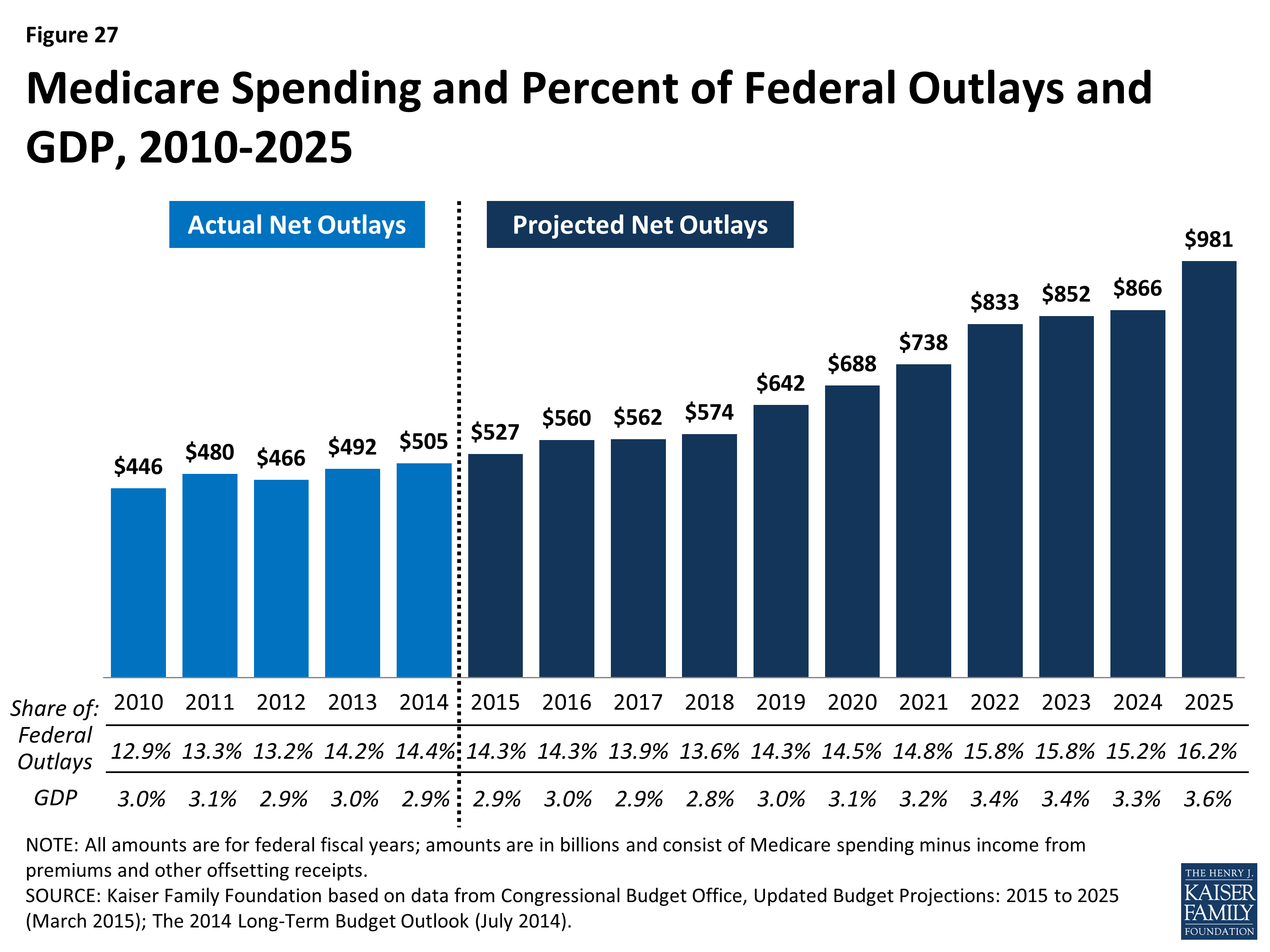

A Primer on Medicare How much does Medicare spend, and how does, Employers are required to withhold 1.45% of each employee’s taxable wages to cover it. The social security wage cap will be increased from the 2025 limit of $160,200 to the.

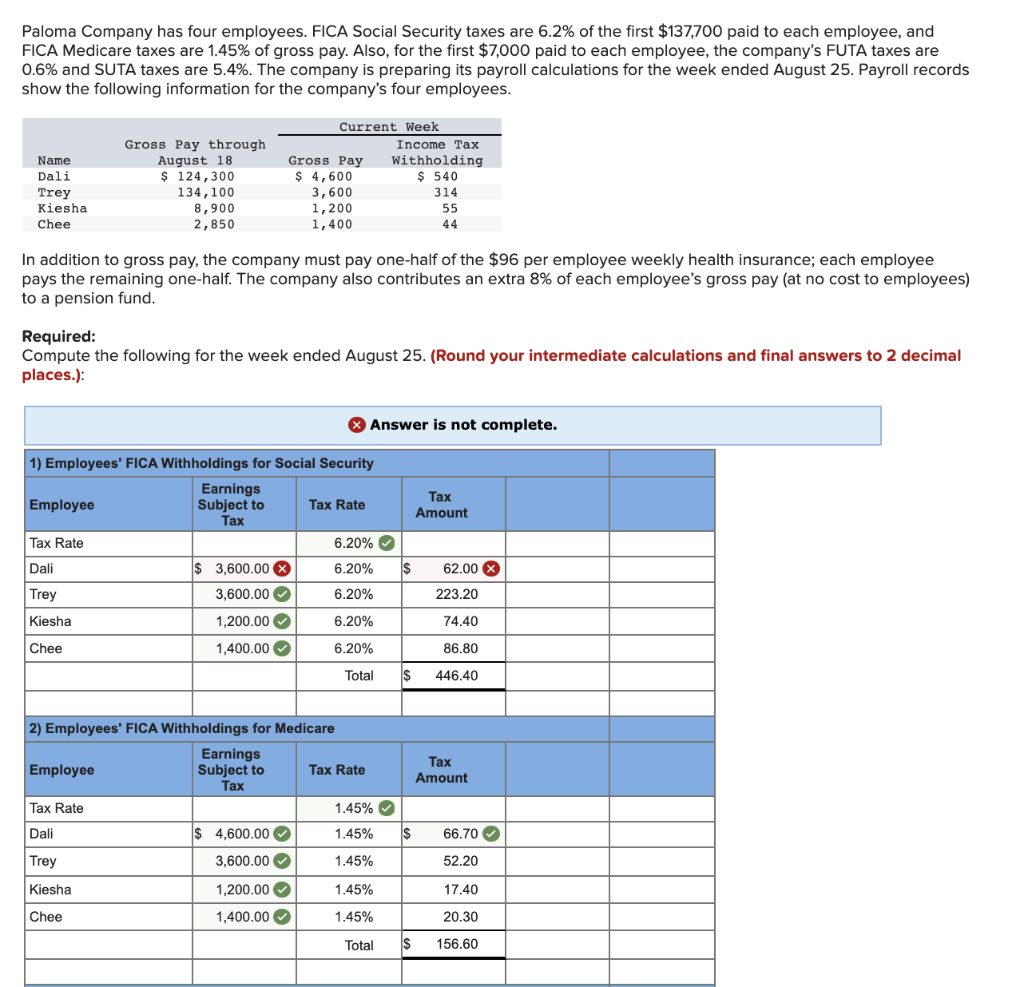

Solved Paloma Company has four employees. FICA Social, The 2025 medicare tax rate is 2.9% total. 1.45% for the employee plus.